With India’s IPO market witnessing record participation in recent years, investors are constantly looking for reliable ways to predict IPO listing gains. Two factors dominate most pre-listing discussions — IPO Grey Market Premium (GMP) and IPO subscription numbers. But which of these indicators actually works better in predicting listing-day performance?

Table of Contents

- 1. Grey Market Premium vs Listing Day Gains

- What the data shows

- But GMP is not perfect

- 2. Subscription Levels vs Listing Day Gains

- Subscription trend vs listing outcome

- 3. Which Subscription Category Matters Most?

- 4. Real IPO Examples: When Indicators Worked (and When They Didn’t)

- High GMP + Strong Subscription = Strong Listing

- High GMP but Weak or Lower-than-Expected Listing

- Low or Mild GMP but Strong Listing

- High Subscription but Weak Listing

- 5. Final Verdict: GMP vs Subscription

- Comparison summary:

- Final Conclusion

In this article, we analyse Indian IPO data from 2019 to 2025, backed by real examples and statistics, to understand whether GMP or subscription figures are more reliable for estimating IPO listing gains — and how investors can use both smartly before applying.

GMP is the unofficial premium at which IPO shares trade in the grey market before listing. A high GMP usually reflects positive market sentiment and expectations of listing gains. A low or negative GMP indicates weak interest.

Subscription data shows how many times an IPO is subscribed overall and across investor categories such as Retail, HNI/NII, and QIB. Higher subscription generally signals stronger demand.

Using IPO data from 2019 to 2025, including GMP, subscription figures, and listing-day performance, we analyse which indicator works better.

1. Grey Market Premium vs Listing Day Gains

Data clearly shows that GMP has a strong relationship with listing-day performance.

According to market studies and media reports, most IPOs list within 15–20% of their grey-market implied price, making GMP a reliable directional indicator.

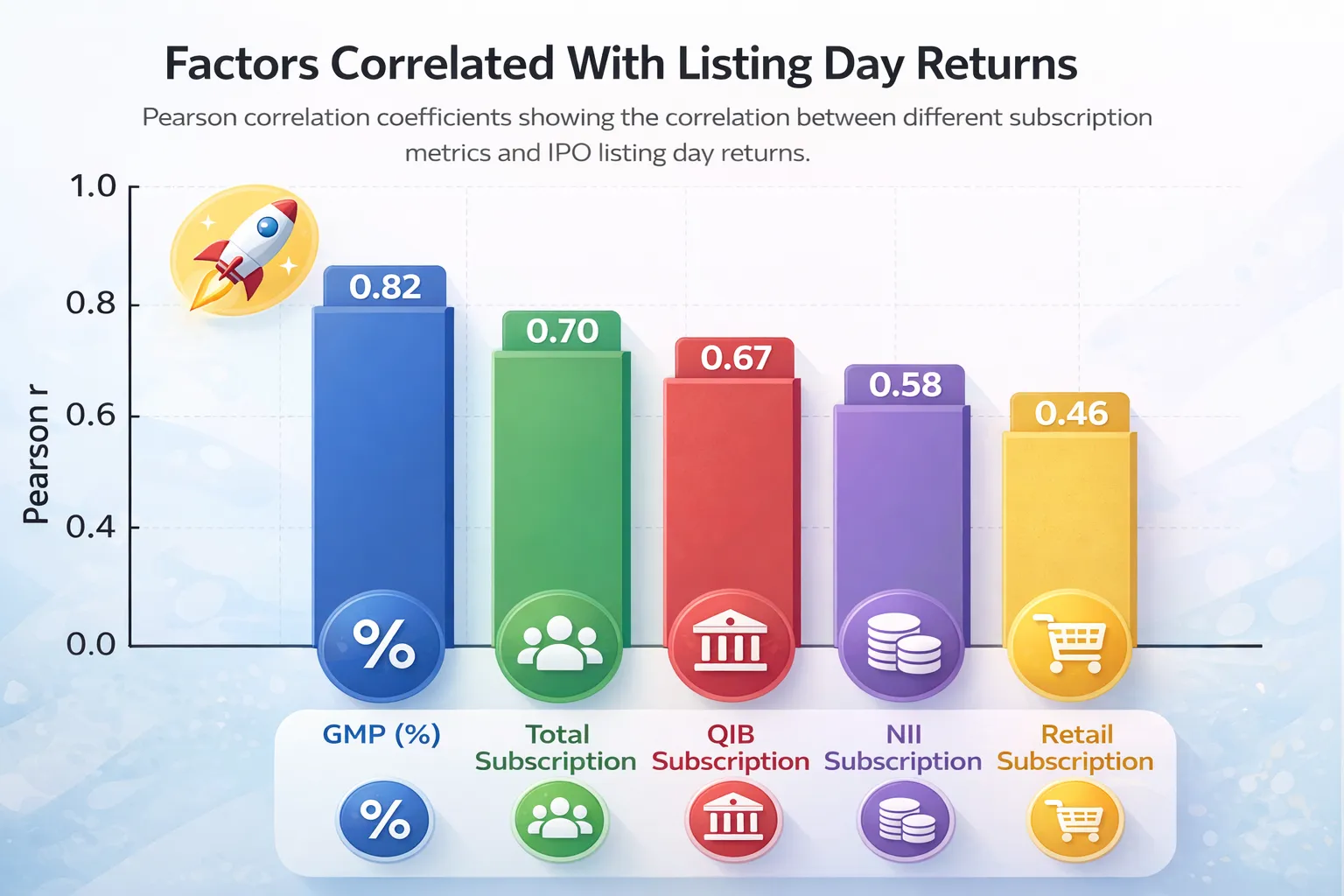

From analysis of around 300 Indian IPOs, the correlation between GMP and listing-day returns is close to 0.8, which is very high.

What the data shows

| GMP Level | Listing Day Outcome |

|---|---|

| Above 30–60% | Almost guaranteed positive listing |

| Above 15–20% | Very high probability of gains |

| 5–15% | Mixed but mostly positive |

| Zero or Negative | Often flat or negative listing |

Simple rule:

Higher GMP = higher chance of strong listing gains

But GMP is not perfect

Since GMP is unofficial and unregulated, it can sometimes be misleading.

-

Some IPOs with low GMP delivered strong listings

-

Some IPOs with high GMP underperformed

These mismatches usually happen due to:

-

Sudden market changes

-

Aggressive valuations

-

Thin or manipulated grey-market activity

Even so, across many IPOs, GMP remains one of the most reliable indicators for listing performance.

2. Subscription Levels vs Listing Day Gains

IPO subscription data also has a positive correlation with listing gains, though slightly weaker than GMP.

A SEBI study (2021–2023) showed that higher subscription generally leads to better listing returns. Our analysis shows subscription has a correlation of around 0.7 with listing-day gains.

Subscription trend vs listing outcome

| Overall Subscription | Listing Behaviour |

|---|---|

| Below 5× | Often flat or negative |

| 5×–10× | Mixed results |

| Above 10× | Good chance of gains |

| Above 50× | Almost always premium listing |

| Above 100× | No recent IPO listed at a loss |

Moderate subscription alone does not guarantee gains, but very high oversubscription strongly improves the odds.

3. Which Subscription Category Matters Most?

Not all subscriptions carry the same weight. Who subscribes matters more than how much.

| Investor Category | Predictive Strength |

|---|---|

| QIB (Institutions) | Strongest |

| HNI / NII | Moderate |

| Retail | Weakest |

Institutional investors are usually more valuation-focused and informed. High retail subscription alone does not ensure listing gains if QIB participation is weak.

4. Real IPO Examples: When Indicators Worked (and When They Didn’t)

High GMP + Strong Subscription = Strong Listing

| IPO (Year) | GMP | Subscription | Listing Gain |

|---|---|---|---|

| Paras Defence (2021) | ₹250–270 (~154%) | 304× | +168% |

| LatentView Analytics (2021) | ₹350–385 (~190%) | 326× | +160% |

| Clean Science (2021) | ₹615 (~68%) | 95× | +98% |

Takeaway: High GMP supported by strong institutional demand usually delivers strong listings.

High GMP but Weak or Lower-than-Expected Listing

| IPO (Year) | GMP | Subscription | Listing Result |

|---|---|---|---|

| MapmyIndia (2021) | ~₹1,050 (~100%) | 154× | +53% |

| Windlas Biotech (2021) | ₹90–110 (~20%) | 22.5× | –11.6% |

| Paytm / One97 (2021) | ₹200–300* | 1.9× | –27% |

*Unofficial roadshow estimates

Takeaway: High GMP alone cannot overcome overvaluation or weak confidence.

Low or Mild GMP but Strong Listing

| IPO (Year) | GMP | Subscription | Listing Gain |

|---|---|---|---|

| Zomato (2021) | ₹8–17 (~12%) | 38× | +53% |

| Groww (2025)* | ~₹5 | 17.6× | +12% |

*Included for trend understanding

Takeaway: Strong fundamentals and institutional backing can beat weak GMP.

High Subscription but Weak Listing

| IPO (Year) | Subscription | GMP | Listing Result |

|---|---|---|---|

| Glenmark Life (2021) | 44× | ₹85–210 | +4% |

| SBI Cards (2020) | 26.5× | High (pre-COVID) | –12% |

| CarTrade Tech (2021) | 20.3× | ₹140 (~9%) | –7.3% |

Takeaway: Heavy subscription does not guarantee listing gains if valuation or market conditions are unfavourable.

5. Final Verdict: GMP vs Subscription

Between the two, Grey Market Premium is the stronger single predictor of listing-day gains.

Comparison summary:

-

GMP → Strongest indicator (highest correlation)

-

Total Subscription → Good indicator, but less precise

-

QIB Subscription → Very important confirmation signal

-

Retail Subscription → Least reliable on its own

A high GMP combined with strong QIB subscription is the best possible signal for listing gains.

However, neither indicator is 100% foolproof. Market conditions, valuation, and company fundamentals still matter. There have been cases where IPOs defied GMP or subscription trends.

Final Conclusion

Over the last five years, GMP has consistently shown better accuracy in predicting IPO listing gains compared to subscription numbers. Subscription data is still important—especially institutional demand—but GMP gives a faster and clearer picture of market sentiment.

Best approach for investors:

-

Use GMP to understand real-time market mood

-

Use subscription data (especially QIB) for confirmation

-

Always check valuation and fundamentals before relying on listing gains

Discussion 0

No comments yet

Be the first to share your thoughts!